Owning and maintaining property can be a financial challenge. There are upfront and ongoing costs to paying a mortgage, bills, repairs, and renovations.

It’s little surprise that some people struggle to keep up.

More than 80,000 people are in arrears of over 2.5% of their outstanding balance.

And the Financial Conduct Authority (FCA) estimates £20 billion in late mortgage repayments is owed in the UK.

What is house repossession?

House repossession is when lenders recover debt by taking possession of properties they have loans secured against. This often happens when a homeowner stops making payments on their mortgage.

However, it can also happen when other types of loan are secured against a property. Once a lender has taken possession of the property, they can sell it to pay off the debt.

UK lenders typically initiate repossession after three consecutive missed mortgage payments. So, don’t fret if you’ve only missed one payment. If you can get back on track, it’s highly unlikely that you’ll lose your property.

If you’re unsure how far behind you need to fall before court action begins, read our guide on How Many Months Mortgage Arrears Before You Face Repossession?

After three months of missed payments, repossession proceedings will begin. But even then, the goal isn’t to get you out of your property immediately. Lenders want to create a repayment agreement. They will likely provide you with advice, too. However, they are not obligated to accept a repayment agreement that you suggest.

In short, it’s in their interest for you to pay them back as best you can. Repossessing your house is a last resort.

How the repossession process works – step by step

In the UK, the Financial Conduct Authority (FCA) has specific guidelines in place that detail the step-by-step repossession process a mortgage lender must follow before they repossess your home.

The first step is for the mortgage lender to let you know of your arrears. They must inform you of the following:

- The size of your arrears

- Details of any payments you have made over the last 2 years

- Interest and fees that will be added to your mortgage

- What your current payments per month should be

- The total remaining debt

You should also get some information on how to seek advice.

You are then free to submit an offer to the lender. It can be as small as you like, but try to be realistic. Don’t offer them small amounts, as this will be a waste of your time and theirs.

You are free to come up with your own offer, and advice helplines will put you on the right path here.

The lender has a legal obligation to consider any offer you make to them. They can accept or reject it, and they must inform you of their decision within 10 days.

If accepted – stop the process:

If your offer is accepted, the process stops. You meet the obligations that you promised, and everything is fine.

If declined – allow you to rectify the problem:

If the offer is rejected, you can make a more suitable offer. However, if you cannot, the lender should give you the opportunity to do a few things:

- Seek benefits or financial help. If you’re unsure what support may be available, find out how the government can help you pay your mortgage.

- Start the process of selling your property for a reasonable price.

If you can demonstrate that you are doing either of those, then the lender will pause the repossession process.

If you are selling your home, the funds you receive from the house sale should go towards paying off the mortgage.

If you still haven’t come up with a solution, the lender must tell you that they’ll be taking you to court. They must inform you two weeks before this happens. You’ll eventually be given a court date, and you’ll have your chance to speak to the court and make a further proposal.

If the judge grants a repossession order, then the final stage of the process begins. The judge may also rule in your favour and grant you time to pay off the arrears. However, you may only have a limited period to do so. At this stage, you’re still free to negotiate with the lender. Find out more information on whether you can appeal a possession order.

A repossession order doesn’t necessarily mean they want to seize your property. Some lenders will take offers right up to the repossession date. However, they no longer have an obligation to respond to your offers.

If the judge rules that your property should be repossessed, you’ll receive a repossession date. This will normally be 28 days away. You must leave your property by this date. If you are still in the property, you’ll be evicted.

The eviction may require a further court order.

How homeowners can avoid repossession

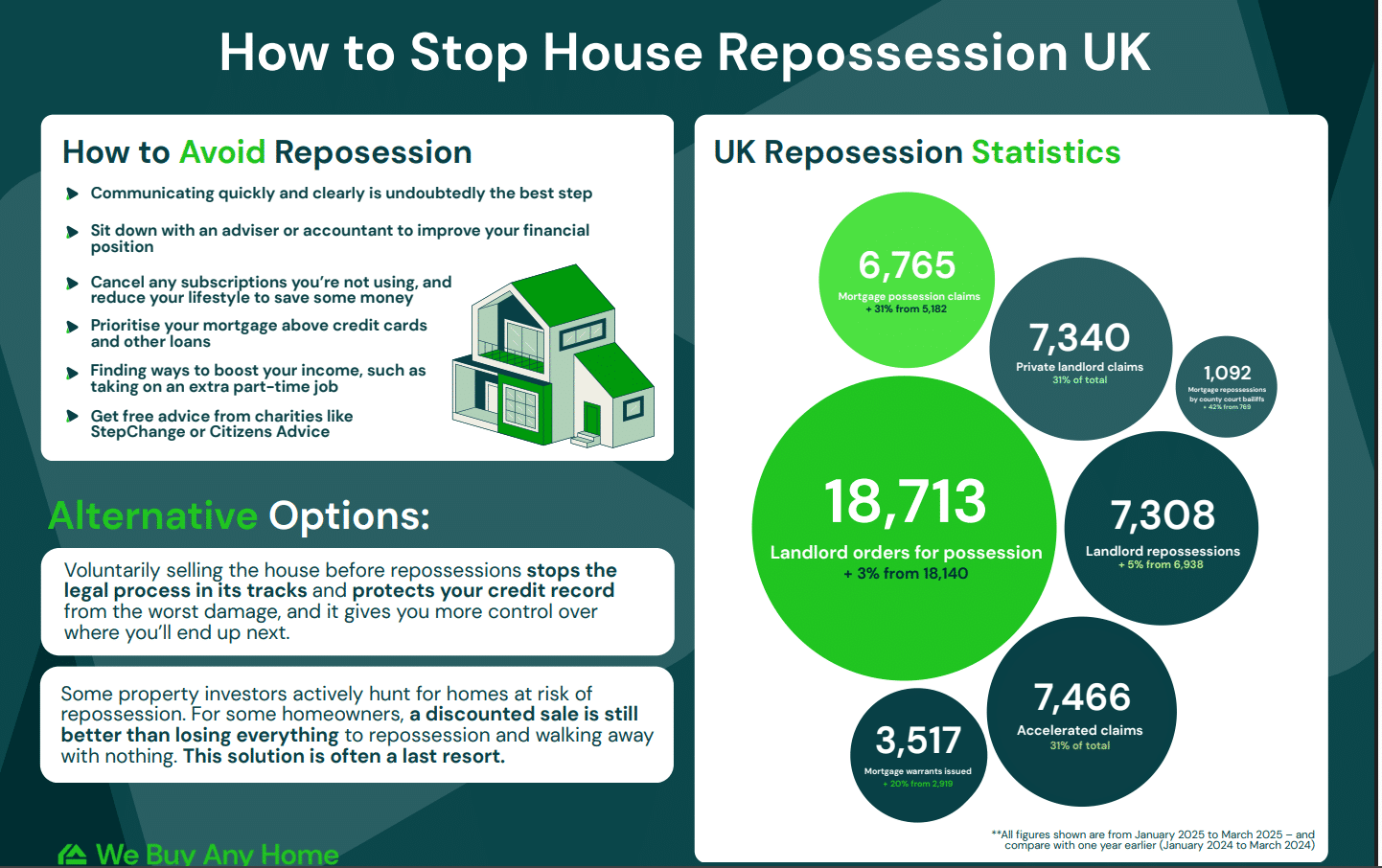

As with all matters financial, communicating quickly and clearly is undoubtedly the best step. In order to present a feasible payment plan, however, you also need to improve your financial position. Sitting down with an adviser or accountant can make this more achievable – especially if you feel out of your depth, or need a fresh pair of eyes.

You may wish to start small. Cancelling any subscriptions you’re not using and keeping an eye on everyday spending can be key. Further to this, you should also prioritise your mortgage above credit cards and other loans.

You may want to be more proactive in finding ways to boost your income. For example, renting out a spare room or taking on an extra part-time job are both solutions to get you back on track in the short term.

Finally, get free advice from charities like StepChange or Citizens Advice. These organisations are on your side and deal with these matters on a daily basis.

Selling the property

When you’re facing house repossession, it can often feel like you have two options: catch up with your mortgage payments, or get the property repossessed. But there are a couple more options that you might not have considered. And one of these is selling the house. If you’re wondering whether this is possible while behind on payments, read our guide on if you can sell while having mortgage arrears.

Sometimes, the smartest move is to sell. Voluntarily selling your home before repossession stops the legal process in its tracks. It protects your credit record from the worst damage, and it gives you more control over where you’ll end up next.

A repossession follows you for years – with lenders, landlords, and insurers. But, if you’re truly backed into a corner with no way out, it can be the last way to save your finances and ensure you aren’t filled with regret for years to come.

Action now will pay off later

The system gives you chances to stop repossession from taking place. If you think that every lender is desperate to repossess your house, then you couldn’t be further from the truth.

Repossessions are a major headache for lenders, and they try to avoid them at all costs. But if you avoid letters, phone calls or hearings, your options will shrink and shrink.

Doing nothing is the worst possible choice. So, whether it’s negotiating, restructuring, seeking advice, or making the hard call to sell, action is what keeps control in your hands.

The people who lose their homes aren’t always the ones who couldn’t pay. Often, they’re the ones who waited too long to face reality.

If repossession is even a possibility in your life right now, don’t ignore it. Taking small, sensible steps now will pay off in the future.